We need to encourage investment in English wine. Setting up a winery in the UK is an expensive business, much more expensive than on the continent where they have a better climate for it. There are no real tax advantages and there is a particular tax disincentive—because of their size, most vineyards will send their grapes somewhere else to be made into wine and so they are not counted as agricultural premises. The tax treatment of the English wine production chain needs to be looked at and restrictions on planting vineyards need to be relaxed.

Only 2,000 hectares of land are under wine production in this country; there are 35,000 in the champagne region in France alone. Up to now, under the EU, we have been restricted from planting new vineyards. Those restrictions have been relaxed until 2030 but technically we are allowed to plant only an additional 1% of vineyards a year—another good reason why we are coming out of Europe as early as possible. That was a very protectionist measure from the days of wine lakes on the continent. We certainly do not have any surplus wine in the UK because it is lapped up as soon as it is produced.

We need some help on planning. We also need some help on duty. This year, wine was the only alcoholic product to receive a duty rise. Duty on wine has gone up considerably over the last 10 years. The duty per average bottle of wine was £1.33 in 2007; it is now £2.08. English wine producers have to pay tax at the same rate as continental wine producers, who can produce it much more cheaply.

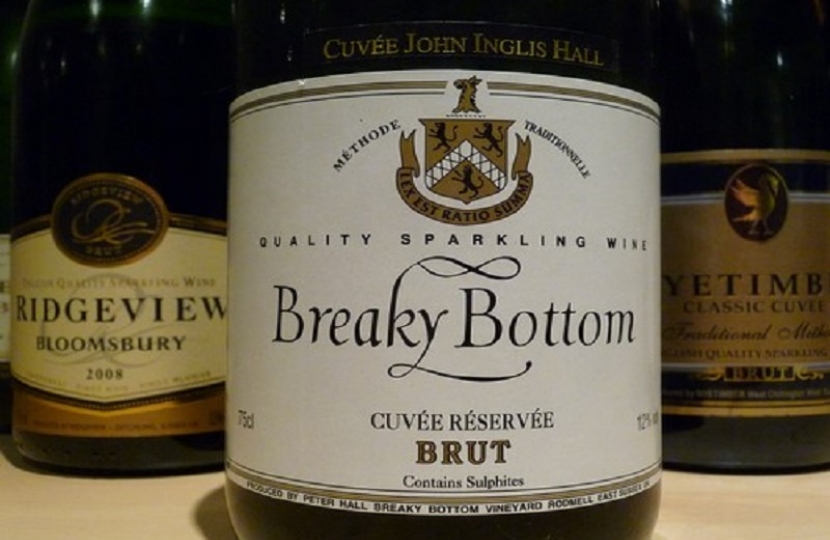

Every embassy around the world should be serving, as the normal staple, English wine and sparkling wine.

You can read the full debate here: https://www.theyworkforyou.com/whall/?id=2016-11-16a.159.0#g165.2