Last year, the Chancellor took an historic decision to cut the duty on spirits by two per cent and to freeze duty on wine. It was the most progressive result for the wine and spirit industry in nearly 20 years and, as the Chairman of the All Party Wine and Spirit group, I raised a glass to George on behalf of our members. It was good for consumers (our constituents), great for supporting jobs (in every seat) and even had a beneficial effect on Exchequer finances. Returns to the Treasury increased by £210 million over just 9 months of the year. To put that into context, the Chancellor’s decision to cut and freeze duty led to more revenue, and could actually pay for the salaries of 9,440 new entry level teachers! It should also be seen in the context of more responsible drinking patterns by young people in particular and a move to better quality.

As we saw from last week’s figures, showing that an extra £8 billion has been raised since higher rate tax was cut from 50p to 45p, it is another example of how fairer tax rates lead, more often than not, to increased revenue for the Exchequer. And that is more money to get the public finances back on to an even keel and to spend on public priorities in public services.

You see, the tax on wine and spirits is – and remains – absolutely and comparatively very, very high. As we all know, it’s something to do with the mechanism that the last Labour Government put in place, which increased the duty levels above inflation by two per cent year on year. It was called the Alcohol Duty Escalator (ADE), and as all good Conservatives know, it was an awful idea. Recognising that it placed an unnecessary burden on the average person and his or her cost of living, our Chancellor, a Conservative Chancellor, scrapped it.

Who doesn’t deserve to enjoy a responsible glass of wine at the end of a hard week? However, due to the heavy legacy of Labour’s ADE, alcohol duties remain at shocking levels. 55 per cent of the average priced bottle of wine and 76 per cent of the average priced bottle of spirits in the UK is now accounted for in tax. Estimates show that only 47p of the money spent on a £5 bottle of wine actually goes on the contents. Again, George’s decision last year to cut and freeze duty had an early effect on this, bringing those numbers down. But there’s much more to do still.

As Chairman of the APPG, I’m calling on George to go one further and give a two per cent cut to wine, as well as spirts, in this year’s budget. And here are some of the reasons why. 600,000 jobs depend on this quintessentially British industry – and that means constituents in every corner of our great islands. So a decision to cut duty would have an impact not just in the South, where we are increasingly crafting some of the best sparkling wines in the world, but the Northern Powerhouse too, as well as Scotland, Northern Ireland and Wales and every town between. UK consumers pay over 40 per cent of all alcohol duty collected across the 28 Members States of the EU and that figure rises to an indefensibly high 67 per cent for wine. The EU doesn’t seem to have helped out much there.

Our own English and Welsh wine industry is growing substantially, with over six million bottles produced last year and a prediction by the industry that this will double by 2020. This industry has made bold forecasts before but, last year, it predicted that cutting duty would increase revenue to the Exchequer. They were right. Exchequer revenue rose four per cent in nine months. Why shouldn’t the Chancellor serve up another round of two per cent cuts?

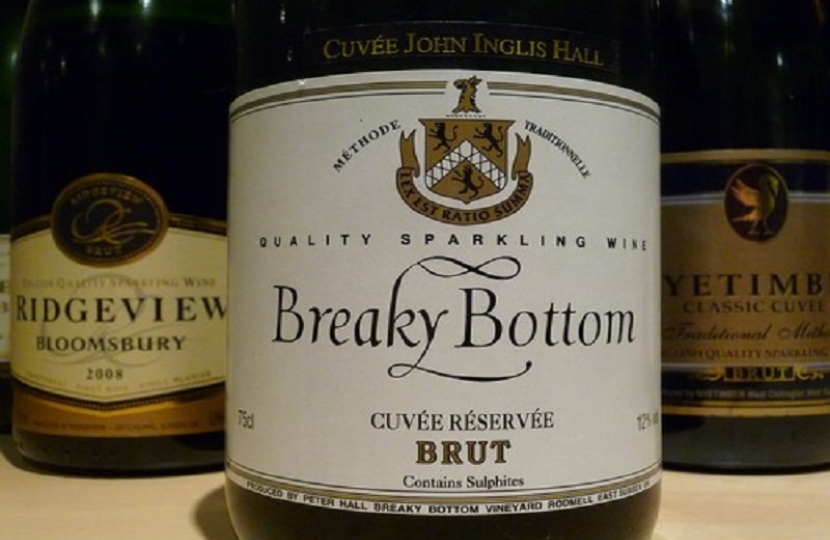

My own favourite English Sparkling should be exported to the world. It’s about time the French had a sip of Breaky Bottom’s 2010 Vintage. It’s better than most of those champagnes at half the price. But to do so, Breaky Bottom and the industry need support at home, to grow and scale and reach export potential, since they have to cope with all the start-up costs of a relatively fledgling industry. It is also anomalous that the rate of duty of sparkling wine is higher than on still wine, yet the alcohol context is typically lower. Can we sort that one out too, please, George – especially with at least three English vineyards aiming to be in the million bottles of sparkling wine a year bracket by 2020?

So, Chancellor, this plea is to you. I know you are an avid reader of ConHome. Drop the duty once more on spirits and, this time, do the same for wine – and let’s start to put the nightmare of Labour’s ADE firmly behind our constituents and their business ambitions. Consumers deserve less tax. We are the party of working people, so let us secure more jobs. The Exchequer could do with more revenue. And the French should be drinking some Breaky Bottom! (Other quality English wines are available – lots of them!)